As much as we may love our pets, and no matter how well-behaved they typically are, it’s essential for us, as responsible owners, to understand that they have the potential to cause problems for people and property alike.

Because of this ever-present potential, we need to ensure we protect ourselves financially in case our pet ever hurts a person, their property, or even their pet.

Thankfully, that’s where pet liability insurance comes into play.

But what, exactly, is pet liability insurance, and why is it so crucial for people to have it? How does it relate to renters insurance, and, most importantly, how much does it cost?

In the post below, our team of passionate pet experts from PetScreening will answer these questions and explore all of the other critical information people need to know about liability pet insurance for renters.

Are you ready? Then let’s jump in!

Pet liability insurance (or animal liability insurance) is a specific type of insurance policy that helps financially protect pet owners in different situations by offering additional coverage for pets.

For example, when someone's pet is responsible for injuring someone or causing damage to someone's property, pet liability insurance can take care of the costs involved.

While it’s a good idea for anyone with a pet to acquire pet liability insurance, it’s especially important for renters since their pets are likely to have more access to other people, their property, and other pets.

At this point, we’d like to take a moment to note that pet liability insurance isn’t the same as pet insurance.

While the former offers protection for damages and injuries caused by someone's pet, the latter acts as a type of pet health insurance.

Basically, pet insurance can help ease the financial burden of expensive veterinary bills for yearly visits, unexpected injuries, serious illnesses, medications, and other treatments for pet owners.

This coverage can be a major benefit for anyone with a pet that’s at risk for serious medical conditions. However, there may be restrictions on pet health coverage options if a pet has preexisting conditions.

Renters insurance is a type of policy that’s very similar to homeowners insurance.

In short, it helps renters protect the personal property they keep within their rented home, apartment, or condo from unexpected circumstances, including fires, floods, and theft.

Like homeowners insurance, a renters policy also includes some amount of liability coverage. Said coverage helps protect people financially from various legal or medical expenses that can occur if someone is injured on the property they’re renting.

While the law doesn't require people to have renters insurance, specific landlords can require it. But even if it's not required, it's always best to protect yourself financially with a quality policy, just in case a problem occurs.

If a renter’s dog bites someone, for example, it’s important for the owner to have a policy that includes pet liability coverage. The average insurance policy will usually cover legal expenses in a dog bite liability case up to the limit, which averages between $100,000- $300,000. If the amount goes any higher, the pet owner is 100% responsible for all remaining damages.

Some insurance companies won’t insure owners with a specific breed of dog, or a dog who has already bitten someone. Conversely, some companies will simply charge a higher premium or make allowances for a dog who has completed a behavior class.

In general, most renter insurance policies include basic coverage for pets under the policy's personal liability coverage, which usually involves two primary components:

If a renter's pet causes damage to someone's personal property, property damage liability coverage may pay out the cost of fixing the damage or replacing the item. However, the cost needs to be within the policy's coverage limit.

For example, say a renter's dog chews up a neighbor's patio furniture or digs up one of their professionally arranged gardens. In that case, property damage liability coverage may cover the costs of replacement furniture and hiring a professional landscaper to fix the garden.

The body injury liability component of a renters policy may protect the policyholder if they are liable for any injuries caused by someone living in the rented property. While not always the case, most bodily damage liability coverage also applies to any pet the renter owns.

Like with property damage liability coverage, any potential payout for bodily damage will depend on whether the costs of medical and legal bills fall under the policy limit cap.

Generally, a renters insurance policy will cover the financial burden a renter experiences if their dog bites someone as part of coverage for bodily injury liability.

So, if a renter's dog bites a neighbor and causes injuries warranting a hospital visit, the policy should cover the victim's medical bills. But again, this coverage has limits. A pet owner can be found liable for medical expenses not covered by insurance.

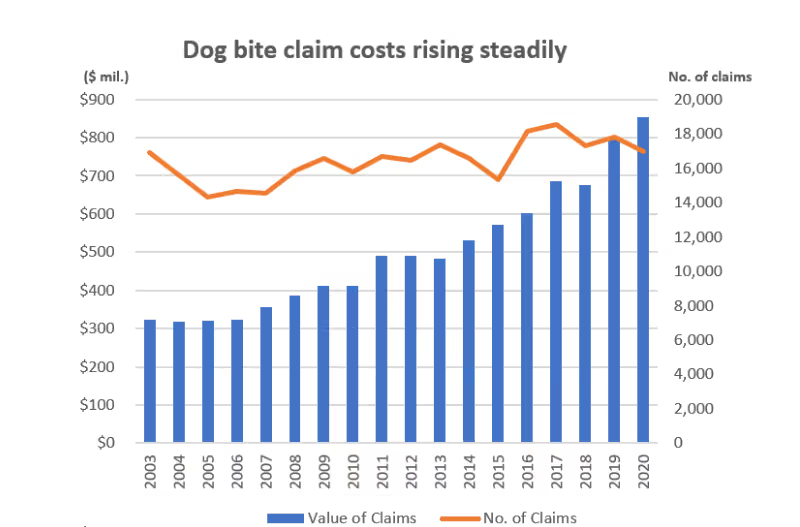

This kind of coverage is incredibly beneficial since the average cost of dog bite claims has increased considerably since the early 2000s — 162% since 2003. The average cost per claim rose to around $50,245 in 2020 due to heightened medical costs and settlement judgments.

That said, every policy is unique, and it’s essential for renters to carefully read their policies to understand any additional limitations, exceptions, or exclusions that they may include for dog bites.

Liability coverage for renters generally doesn’t apply to personal injuries or property damage.

In short, this means renters liability coverage won't cover damage to the renter's property or any medical costs from personal injuries they receive from their own dog. Additionally, most renters insurance policies won't cover injuries for anyone else living on the rented property.

For example, say a renter lives with their family and dog in a condo. One day the dog bites and injures the renter’s child by accident while playing. Their renters insurance pet liability would classify that as a personal injury and wouldn’t provide any coverage.

Or, say that the renter’s dog gets bored one day and decides to chew a hole through the renter’s couch or knock over the TV. Because the dog damaged the renter’s personal property, renters insurance is unlikely to cover the damages.

Unfortunately, many insurance agencies across the United States actively exclude different kinds of pets and pet breeds from coverage under their renters insurance policies. This means they won't cover the cost of any damage or injuries caused by these pets.

These exclusions aren't present in every policy or used by every insurance agency. In fact, several agencies actively boast their lack of coverage exceptions for pets to attract clients who have trouble finding other coverage.

However, it’s essential for pet owners to understand that exceptions are very common. The most prevalent exceptions for pet coverage typically relate to the following:

Despite evidence that a dog's breed doesn't predict behavior, many insurance agencies have strict breed restrictions for their policies. This means renters may not be covered under their renters insurance if their dog causes an injury or property damage.

Some of the most common dog breeds that insurance agencies refuse to cover include:

Other dogs often barred from coverage under insurance policies include mixed breeds (containing any of the breeds above), wolf hybrids, and guard dogs.

Alongside breed exclusions, insurance policies may not cover dogs with a prior history of biting people or animals. Many insurance companies also don't make exceptions for provocation or self-defense when a dog bites someone.

In some cases, policies may also exclude any dog who displays a "vicious temperament" in view of an insurance agency employee.

While there is no exact definition of what an exotic pet is, the term often applies to non-domesticated animals brought into people’s homes. However, a broader definition also includes any pet that isn’t a cat, dog, or farm animal.

Depending on the definition used by the insurance agency in question, their policies may exclude liability coverage for:

A renter with these pets should review their policy and talk to an insurance agent to learn whether their pets are covered.

Usually, renters insurance companies include some type of liability pet coverage as part of a renter’s base premium — meaning it won’t add an extra cost to their insurance policy. However, this can vary significantly between both individual policies and the insurance agencies that provide them.

Because of this, renters should always make sure to check their policy and talk with their insurance agent about whether their pets will increase the cost of the plan overall.

If the presence of pets does increase the cost of a renters policy, it may be worth it to shop for a different policy or even switch insurance providers altogether.

If a renter buys pet liability insurance - whether in place of or in addition to renters insurance coverage - the monthly cost will depend on several factors, including:

Depending on these factors and the amount of pet liability coverage a renter wants, pet liability policies can be as inexpensive as $10 per month and provide between $10,000 and $30,000 worth of extra coverage.

Deductibles for pet liability insurance can vary significantly and range from $250 to $2,500, depending on the policy.

Even if someone’s specific renters insurance policy provides liability coverage for their pet, there are several reasons to consider purchasing pet liability insurance.

For example, their renters insurance may have a low limit on bodily injury liability or property damage coverage. This means that if major damage or serious injuries occur because of their pet, the policy may not cover all of the costs involved.

This issue is especially significant for owners of larger, more powerful dogs, which can easily cause a lot of damage to other people and their property, even by accident.

However, whether a renter has a large dog or a smaller pet isn't the primary issue. In the end, the out-of-pocket cost they may have to pay for any damage or injuries their pet causes is something all pet owners should want to avoid.

Basically, if your pet has the potential to bite, scratch, knock someone over, or cause any type of damage to someone (even if the damage is minimal), you may want to consider a pet liability insurance policy.

That said, there’s another insurance alternative that pet owners may want to consider if they’re looking to cover more than just their pet.

Generally, a pet owner will sign up for pet liability insurance if their renters insurance either won’t cover their pet or doesn’t provide enough coverage to pay for the damage or injuries their pet may cause.

While pet liability insurance alone is usually enough of a buffer to financially protect pet owners from any issues they may encounter, sometimes even that may not feel like enough.

Pet owners who don’t feel like they’re covered enough through their renters and pet liability insurance can also take out an umbrella policy to supplement their liability claim limits.

Umbrella insurance, much like pet liability insurance, is a type of secondary coverage people can get on top of their other insurance policies that can be a great source of additional financial protection.

Unlike pet liability insurance, however, an umbrella policy also covers costs for damages and injuries completely unrelated to a renter’s pets.

Pet liability insurance is a fantastic tool that responsible pet owners should consider leveraging to protect themselves financially if their pet injures someone or damages their property.

But there’s no need for pet owners to stop at pet liability insurance when caring for their pets. They can also use PetScreening to help make pet ownership a breeze!

When you make an account with us, you can use our unique service to create a digitalized pet profile for your canine companion to take with you wherever you go!

Check out our website to learn about how we can help you submit accommodation requests for an assistance animal when you move, and take a second to explore our Bark Library for more great information.